x

Market Holidays Click Here

Leverage

Leverage enables traders to amplify their market exposure with a fraction of the capital. This potentially magnifies both profits and losses, offering a dynamic approach to trading.

What is leverage

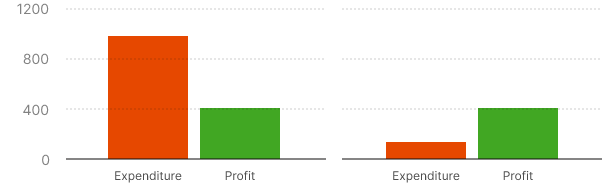

NO LEVERAGE TRADING

500X LEVERAGE TRADING

Advantages of Using Leverage

Leverage serves as a potent instrument for traders, enabling them to broaden their presence in financial markets and optimize capital utilization while investing a smaller amount.

Amplifying Market Exposure

Allows you to control a larger position size than your invested capital, amplifying market exposure.

Magnifying Profits

Can be used to make the most of your available capital, potentially maximizing returns.

Accessing Larger Markets

Opens the door to larger markets and assets that might be otherwise inaccessible with limited capital.

How traders might use leverage

Forex/Metal/Oil

| Account Equity | Leverage Limit |

|---|---|

| 0~999.99 | 1000 |

| 1000~4999.99 | 800 |

| 5000~9999.99 | 500 |

| 10000~20000 | 200 |

| 20000+ | 100 |

Cryptos

| Symbols | Fixed Leverage |

|---|---|

| BTCUSD, ETHUSD, LTCUSD | 100 |

| BCHUSD, XRPUSD, ADAUSD, EOSUSD, DOTUSD, DOGEUSD, LINKUSD | 50 |

| MANAUSD, SANDUSD, MATICUSD, AXSUSD | 10 |

Indices

| Symbols | Fixed Leverage |

|---|---|

| US30, US100, US500, UK100, China50, HongKong50, AU200, Japan225 | 100 |

Shares

| Symbols | Fixed Leverage |

|---|---|

| All Shares | 20 |

Examples

Margin Trading: Traders can use leverage to enter positions larger than their account balance, known as margin trading.

Example 1: With a leverage of 200:1, a trader can control a position worth $200,000 with only $1,000 of their own capital.

Example 2: With a leverage of 500:1, a trader can control a position worth $500,000 with only $1,000 of their own capital.

Important Leverage Information

Elastic leverage policy

Compared to fixed levers, elastic levers are floating. NCE implements flexible maximum leverage rules to satisfy professional investors who wish to use higher leverage under specific conditions. The system adjusts the maximum leverage according to the customer's current net worth level every 30 seconds to one minute.

Leverage reduction

It is recommended that investors who require high leverage can withdraw or transfer a certain proportion of funds to another account of the same name once their net worth triggers the leverage reduction standard.

Leverage and Trading Profit/Loss

It is easy for novice traders to mistakenly believe that leverage will affect the profit and loss results of trading. In fact, it is the position size and not the leverage that affects the profit and loss. For two accounts using 1000x leverage and 1x leverage, trading the same product and the same lot size, the profit and loss results will be the same.

Negative balance protection

NCE strictly implements the regulatory negative balance protection policy, and investors do not need to repay losses that exceed their own funds. When there is a gap in the market, excessive leverage is more likely to lead to negative equity in the account. If a customer has negative equity twice in the same month, the maximum leverage will be limited to 200, and it will take 30 days to return to normal levels.

Abuse of leverage

For illegal traders who place orders that do not meet the daily trading scale before the weekly close and key economic statistics data releasing time, and intend to obtain illegal profits through the negative balance protection policy, the accounts will be disabled. All consequences such as withdrawal delays or even profit cancellation must be borne by the illegal traders themselves.

Join a community dedicated to your success in the world of finance. Your journey to financial empowerment begins with a simple click.